AI-Powered Trading Analytics & Journaling.

Bridge the gap between amateur emotion and professional discipline with institutional-grade trading telemetry.

DON'T JUST TRADE. EVOLVE.

Is biological bias destroying your alpha? Stop fighting your instincts and start engineering them. biasOS™ is the world's first Trading Telemetry System designed to decode your behavior, automate your discipline, and clone the consistency of a quant desk.

TOTAL NEURAL SYNC

Stop manually journaling. Connect your broker via read-only API and let our engine ingest years of your trading history in seconds.

We instantly calculate your baseline stats—Sharpe ratio, expectancy, and volatility—creating a digital twin of your trading personality.

BEHAVIORAL DEBUGGING

You can't fix what you can't see. Our pattern recognition algorithms don't just look at price; they look at you.

We detect the invisible leaks in your game—tilt, instrument fatigue, and session drift—alerting you before a bad habit becomes a blown account.

ALGORITHMIC DISCIPLINE

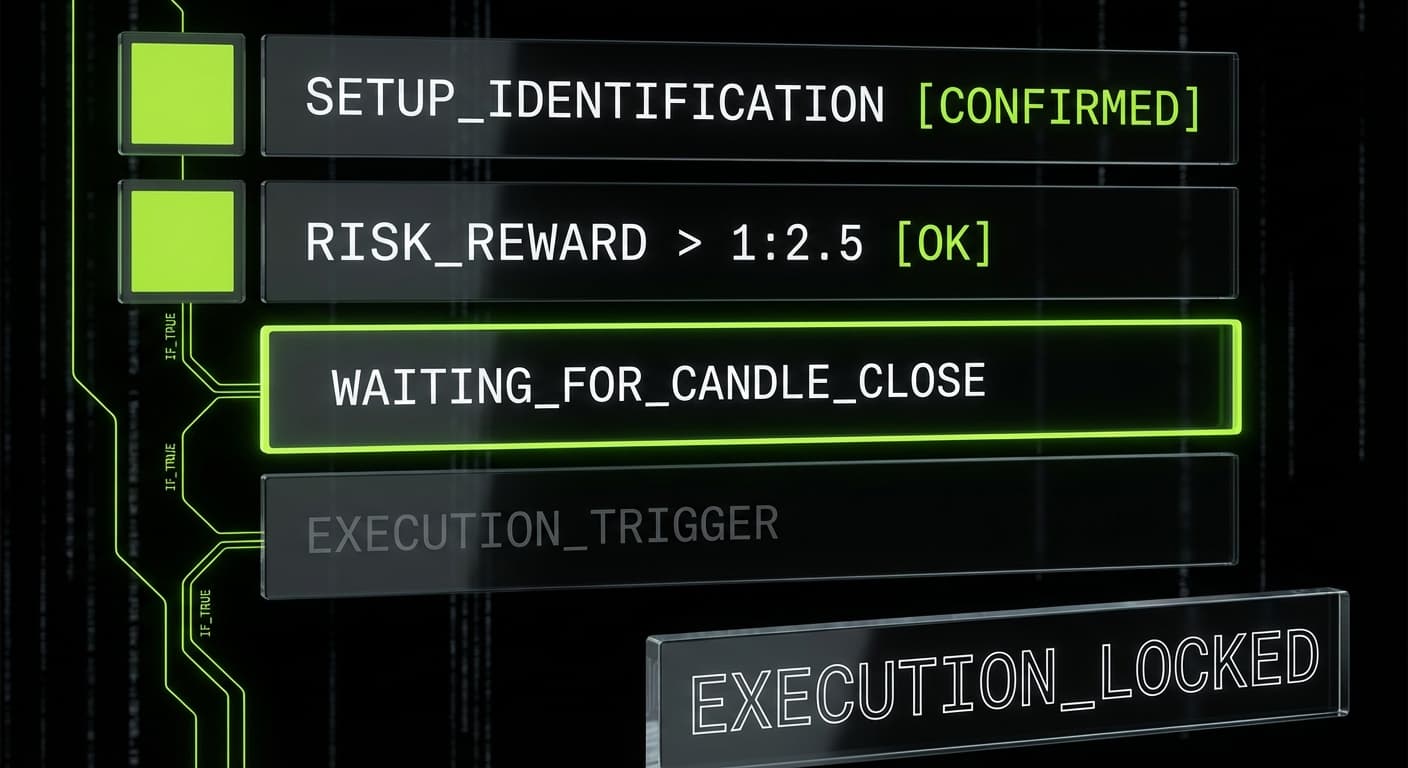

Willpower is a finite resource. Automation is forever. Deploy "Smart-Lock" protocols that help prevent you from breaking your rules.

If your stats degrade, the system tightens your risk. It's not just a journal; it's an automated risk manager that protects you from yourself.

Join other profitable traders optimizing their edge

Professional Trading Tools for Consistent Performance

Comprehensive trading analytics, journaling, and strategy management tools designed to eliminate emotional trading and build systematic edge in the markets

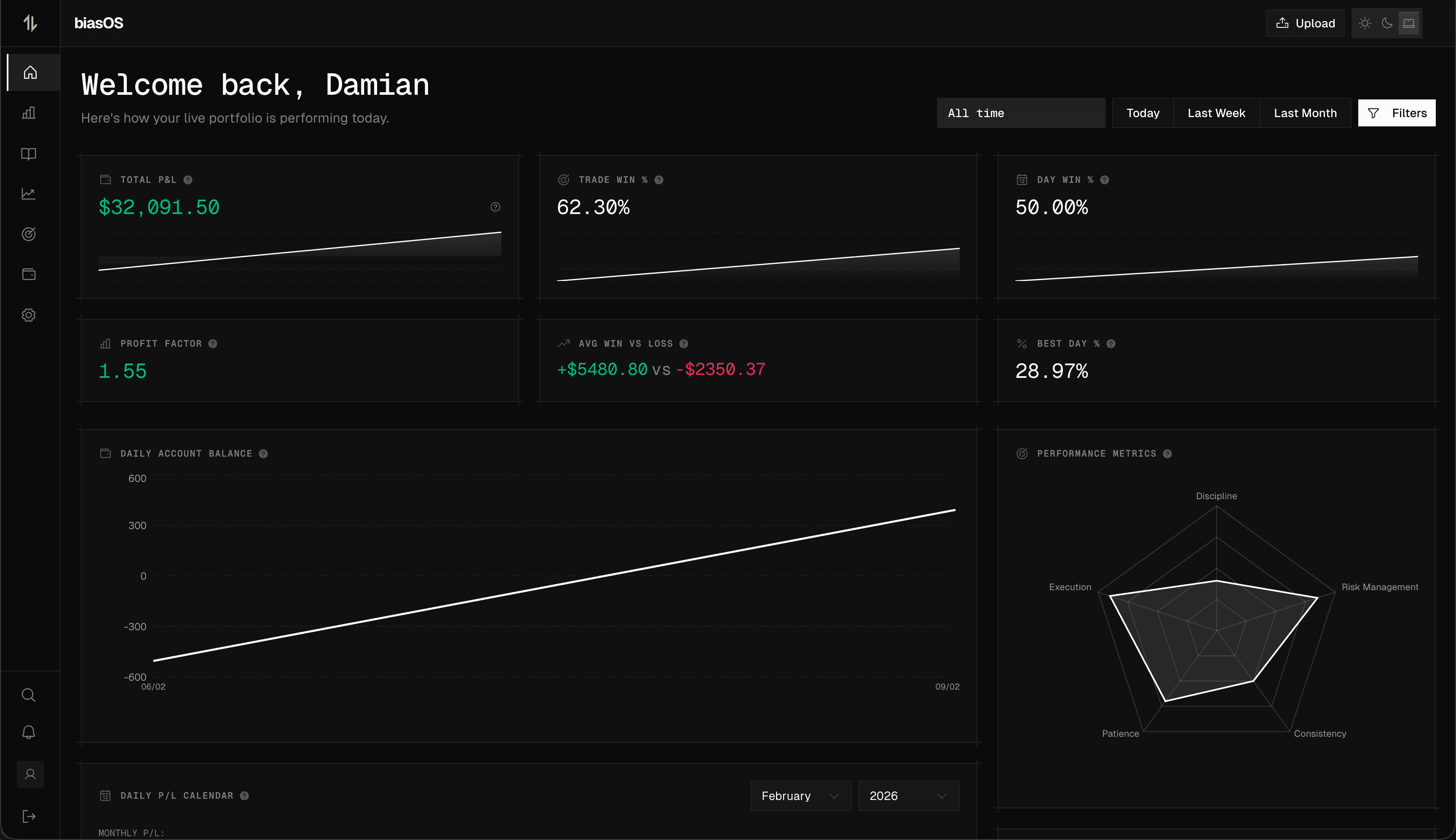

Real-Time Trading Analytics & Market Insights

Access comprehensive real-time trading analytics with institutional-grade metrics. Track your performance across all positions, monitor live P&L, win rates, and trading patterns with advanced data visualization and market insights.

Advanced Backtesting & Trade Replay Engine

Validate trading strategies with powerful backtesting tools against historical market data. Replay past trades with full market context, order flow visualization, and execution analysis to improve your trading edge.

AI-Powered Trading Journal & Performance Insights

Document every trade with an intelligent trading journal that identifies behavioral patterns, cognitive biases, and emotional triggers. Get personalized insights and actionable feedback to develop consistent trading discipline.

Trading Strategy Checklists & Playbook Management

Build and enforce trading discipline with customizable strategy checklists and playbooks. Ensure setup validation, risk management compliance, and execution consistency across all trading sessions.

YOUR PSYCHOLOGY IS THE BOTTLENECK.

Strategies don't fail. Humans do. While you fight your instincts, the algos are taking your liquidity. biasOS acts as a Behavioral Firewall, sanitizing your decision-making process so you can execute with the cold precision of a machine.

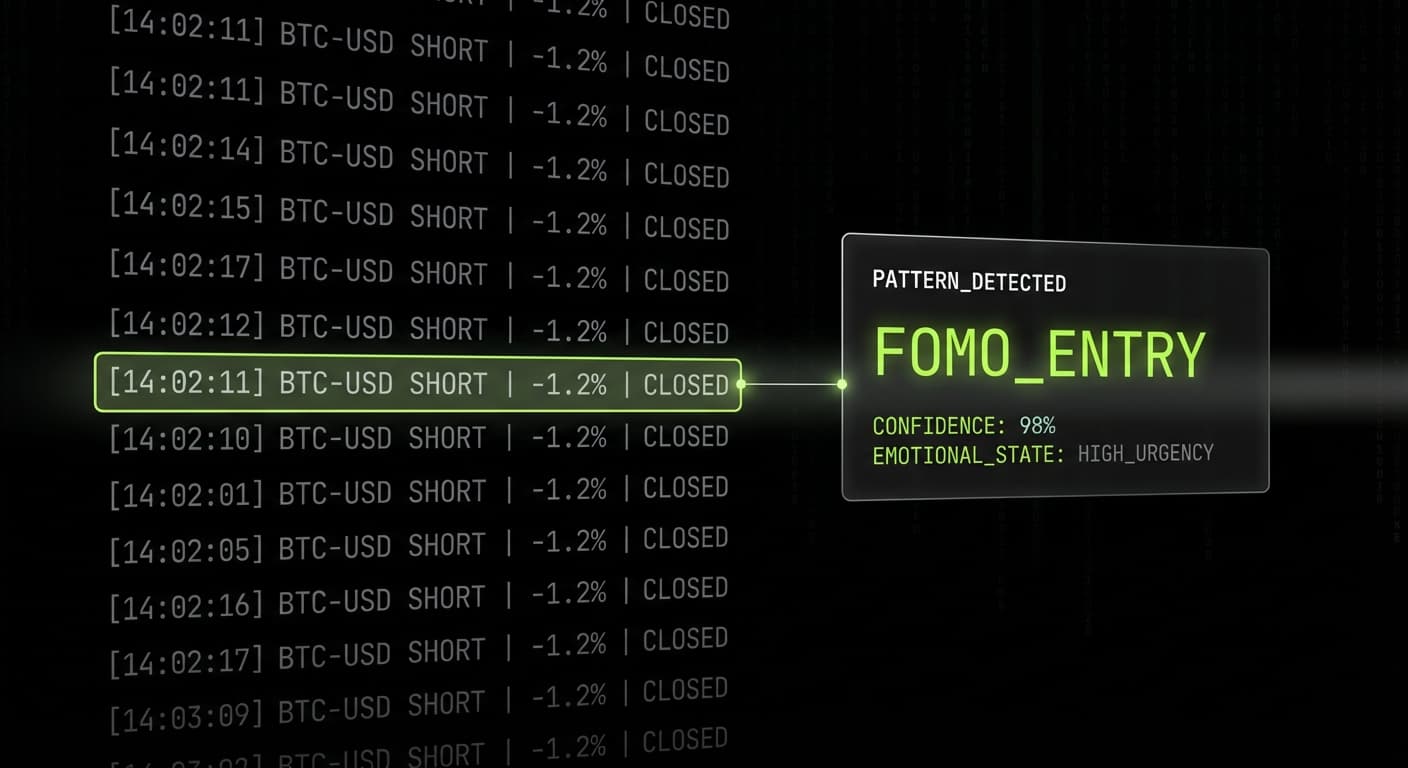

DECODE YOUR FAILURE SIGNATURE

Every trader has a unique "loss fingerprint"—specific conditions where you consistently bleed money. Our Algorithmic Fingerprinting isolates these toxic patterns (FOMO, revenge, hesitation) instantly, turning your subconscious flaws into visible data points.

Pattern recognition for traders, identify trading leaksVOLATILITY SUPPRESSION

Your PnL is volatile because your mind is. We don't just track price; we track your Emotional Variance. By quantifying your discipline, biasOS alerts you when your internal volatility exceeds safe thresholds, stopping the "tilt" before it wipes the week.

Stop revenge trading, manage trading psychologyPRESERVE MENTAL CAPITAL

Decision fatigue is real. Stop wasting 50% of your energy on manual tracking and rote analysis. We automate the telemetry, freeing up your cognitive bandwidth for what actually pays: high-level execution and strategy deployment.

Automated trading journal, cognitive load in tradingSTRESS-TEST YOUR THESIS.

Hope is not a risk management protocol. The market is a graveyard of untested theories. Don't be a casualty. Subject your trade logic to a Monte Carlo Stress Chamber, simulating 10,000 scenarios against institutional tick data in milliseconds. Expose the failure points before you deploy capital.

DEEP-TICK PRECISION

High-fidelity backtesting dataForget candle closes. We validate against Tick-Level Data, exposing slippage and liquidity voids that standard backtesters hide. If it doesn't work here, it won't work live.

PROBABILISTIC FORECASTING

Monte Carlo simulation tradingLinear backtesting is a lie. Our Monte Carlo Engine shuffles market conditions to show you not just what did happen, but what could happen. Know your worst-case drawdown down to the cent.

VARIANCE ANALYSIS

Strategy robustness checkIs your edge real, or was it just luck? We calculate the Statistical Significance of your win rate, separating true alpha from random market noise.

OBSOLETE YOUR SPREADSHEET.

Static logs are for historians. Dynamic telemetry is for operators. Stop treating your trading business like a clerical task. Bridge the gap between Manual Data Entry and Autonomous Intelligence.

| THE SPEC SHEET | biasOS™ THE WEAPON | LEGACY LOGS THE FOSSIL |

|---|---|---|

AUTONOMOUS DATA INGESTION Automated Broker ImportStop typing. We pull read-only trade data instantly via API. | INSTANT | MANUAL ENTRY |

PREDICTIVE ALPHA MODELING Monte Carlo SimulatorDon't just look back. Project future equity curves based on win-rate variance. | NATIVE | IMPOSSIBLE |

BEHAVIORAL FINGERPRINTING Trading Psychology AnalyticsDetects "Tilt," "Revenge," and "Fatigue" based on execution timing deviations. | ACTIVE MONITORING | PASSIVE TEXT |

TICK-LEVEL REPLAY ENGINE Market Replay ToolRelive the execution. See the bid/ask spread and liquidity at the exact moment of entry. | HIGH FIDELITY | STATIC CHART |

REAL-TIME RISK HEATMAPS Portfolio Risk ManagementVisualize exposure across all pairs instantly to prevent over-leveraging. | LIVE | DELAYED |

EXPECTANCY DRIFT ALERTS Trading Performance AlertsGet notified the moment your live trading deviates from your backtested edge. | AUTOMATED | NONE |

"You are competing against algorithms that process terabytes of data in nanoseconds.

And you're using Excel? Good luck."

THE OPERATING SYSTEM FOR ELITE EXECUTION.

Fragmented tools lead to fragmented results. biasOS integrates every pillar of professional trading into a single, cohesive ecosystem. Stop jumping between spreadsheets and charts—start operating within a high-performance infrastructure.

TELEMETRY & ANALYTICS

Why are you still typing? biasOS provides Autonomous Data Ingestion across MT4, MT5, and major Crypto exchanges. Get institutional-grade telemetry that maps every execution and PnL curve with zero manual effort. If you didn't log it, it didn't happen. Now, it happens automatically.

Automated trading journal MT4 MT5, Crypto trading analyticsBEHAVIORAL FIREWALL

Standard journals tell you what happened. We tell you why. Our AI-Driven Pattern Recognition decodes your Behavioral DNA, identifying the exact moment FOMO or revenge trading enters your execution. We don't just identify bias; we provide the firewall to stop it in real-time.

Trading psychology AI, behavioral bias identificationRISK QUANTIFICATION

Guessing your position size is a recipe for liquidation. Use our Monte Carlo Engine to stress-test your strategy against 10,000 market variations. Understand your Probability of Ruin before you click "buy." Deploy risk command protocols that keep you in the game when the market gets volatile.

Monte Carlo simulation trading, probability of ruin calculatorTHE STRATEGY FACTORY

Verify your edge against 10 Years of Institutional Tick Data. Build rigid Playbooks with automated checklists that force you to follow your own rules. Ensure every trade meets your statistical confluence requirements—no exceptions, no "gut feelings," just math.

Institutional tick data backtesting, trading playbook softwareCOMMAND YOUR EDGE.

The markets don't care about your feelings; they only respond to math. Stop manual guessing and start operating with quant-level precision. Join profitable traders who have offloaded their discipline to the biasOS protocol.

Sync your first broker in < 60 seconds.